Apply for Capital One Credit Card Offer Online :

The Platinum MasterCard from Capital One is a no-yearly charge choice for individuals with normal credit. It additionally has no unfamiliar exchange charges and no punishment APRs. While this card gets going with a low credit limit, cardholders might be qualified for an expanded cutoff after as not many as five regularly scheduled installments.

Given that the card is intended for individuals with simply reasonable credit, it conveys a moderately high loan fee. In any case, you can keep away from that high premium by taking care of your equilibrium each month. If you have great or astounding credit, you could probably fit the bill for a card with a much lower loan fee. The APR on buys for this card is above 22%, so on the off chance that you hope to convey a month-to-month balance, you’ll address a precarious cost.

Capital One Credit Cards:

- Platinum MasterCard

- Venture Rewards

- VentureOne Rewards

- VentureOne Rewards for Good Credit

- Quicksilver Rewards

- Quicksilver Rewards for Good Credit

- Savor Rewards

- SavorOne Rewards

- SavorOne Rewards for Good Credit

- QuicksilverOne Rewards

- Journey Student Rewards

- Secured MasterCard

- Capital One Walmart Rewards MasterCard

- Spark Cash

- Spark Miles

- Spark Cash Select and so on.

Features of Capital One Platinum MasterCard:

- You will not compensate a yearly charge to have this card, which is a decent arrangement when you haven’t set up incredible credit yet or are remaking your credit.

- Despite the fact that the Platinum charge card from Capital One has no prizes segment it voyages well. At the point when you utilize the card outside of the United States, you can make buys in either U.S. dollars or the nearby money, without bringing about an extra expense.

- You could see an acknowledged limit increment after just five months of on-time installments. So ensure you two or three days ahead to guarantee your installments post on schedule.

- Likewise, make sure to keep adjusts low, which will support your FICO rating over the long run.

- In the event that you have recently normal credit, you probably will not fit the bill for a reward on any card without a yearly expense. So while a con, it’s comparable to different cards you should think about.

- This is a nitty-gritty card for building credit. Notwithstanding, it’s a no-nonsense card with no yearly expense.

Rates of Capital One Platinum MasterCard:

- Regular APR is 24.99%

- Annual fee is $0

- This card does not offer a rewards program.

- There is no standard balance transfer fee for this card.

- Foreign transaction fee is 0%

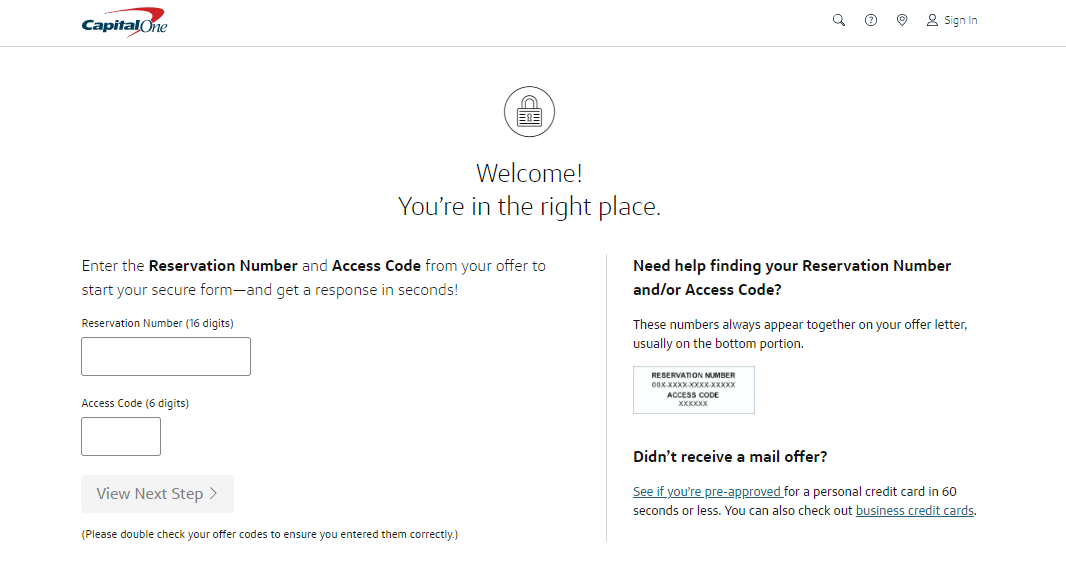

Apply for Capital One Credit Card get my Offer:

- Capital One provides different credit cards. Here you will see the initials of Capital One Platinum MasterCard.

- If you have received the offer open the page getmyoffer.capitalone.com

- Once the page opens at the central reservation number, the access code.

- Now click on the ‘View next step’ button.

How to Get Pre Approved with Capital One Credit Card :

- To see the pre-approval open the page getmyoffer.capitalone.com

- Once the page opens at the center click on the ‘See if you’re pre-approved button.

- In the next screen provide your name, date of birth, SSN, your address, phone number, email, if you have a bank account, employment information, card details you are interested in, read the terms, and click on ‘See if I’m pre-approved button.

Apply for Capital One Platinum MasterCard:

- Capital One has several credit cards. Here let’s know about the Platinum MasterCard.

- To apply for the card open the page capitalone.com/credit-cards

- As the page opens at the center under the Platinum MasterCard section hit on ‘Apply now’ button.

- In the next screen provide your personal information, contact details, financial initials, additional information, read the terms click on ‘Continue’ button.

Capital One Credit Card Login:

- To login open the page www.capitalone.com

- After the page appears at top right click on ‘Sign in’ button.

- In the next screen provide username, password click on ‘Sign in’ button.

- You can also use the login to pay the credit card bill online.

How to Retrieve Capital One Credit Card Login Initials:

- To retrieve the login details open the page www.capitalone.com

- After the page opens you have to click on ‘Forgot username or password?’ button.

- In the next screen provide your name, SSN, date of birth click on ‘Find me’ button.

Also Read : Apply for Chase United MileagePlus Card

Sign Up for Capital One Credit Card Account:

- To sign up for the account, open the page www.capitalone.com

- Once the page appears at the login homepage now hit on ‘Set up online access’ button.

- You will be forwarded to the next screen provide your name, SSN, date of birth click on ‘Find me’ button.

Activate Capital One Platinum MasterCard:

- To activate the card open the page www.capitalone.com

- As the page appears at the login homepage you have to login with the required information.

- After logging in you can use the credit card.

Capital One Credit Card Bill Pay Through Phone:

- You must have the payment information and pay the bill through toll-free phone number.

- You have to call on, (800) 227-4825.

Capital One Credit Card Bill Pay Through Mail:

- To pay by mail you can send the payment through cash or check

- You have to send the payment to, PO Box 71083. Charlotte, NC 28272-1083.

Capital One Credit Card Bill Pay In Person:

- You can pay the bill in person at MoneyGram or Western Union places.

- You have to provide the credit card number to pay the bill.

Capital One Credit Card Customer Service :

To get further information call on the toll-free number 1-877-383-4802.

Reference Link: